S.I. No. 429/2015 - Central Bank Act 1942 (Section 32D) Regulations 2015.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 13th October, 2015. | ||

In exercise of the powers conferred on it by section 32D of the Central Bank Act 1942 (as inserted by the Central Bank Reform Act 2010 ) the Central Bank Commission hereby makes the following regulations which are effective with the approval of the Minister for Finance: | ||

1. These Regulations may be cited as the Central Bank Act 1942 (Section 32D) Regulations 2015. | ||

2. In these Regulations: | ||

“the Principal Act” is the Central Bank Act 1942 ; | ||

“The Client Asset Requirements” are requirements imposed on investment business firms and investment firms pursuant to Section 52 of the Investment Intermediaries Act 1995 , Regulation 79 of the European Communities (Markets in Financial Instruments) Regulations 2007 or client asset regulations imposed on regulated financial service providers pursuant to regulations issued under Section 48 of the Central Bank (Supervision and Enforcement) Act 2013 ; | ||

“due date” is | ||

(a) the day that falls 28 days after the date of issue of the levy notice, as specified on such levy notice, or | ||

(b) the date referred to in Regulation 10, or | ||

(c) a date otherwise referred to in these Regulations as being a due date for payment of a levy contribution and/or a supplementary levy contribution or part thereof; | ||

“levy contribution” is the amount determined as being due and owing which is calculated in accordance with the Schedule hereto; | ||

“supplementary levy contribution” is any supplementary levy determined as being due and owing, in addition to the levy contribution, in accordance with the Schedule hereto; | ||

“levy notice” means each notice specifying a levy contribution and/or supplementary levy contribution sent by the Bank to a regulated entity in accordance with these Regulations; | ||

“levy period” means the period prescribed in the Schedule hereto in respect of which regulated entities are obliged to pay a levy contribution and, where applicable, a supplementary levy contribution; | ||

“subsequent levy period” means the period from 1 January 2016 to 31 December 2016 inclusive; | ||

“regulated entities” means persons who are subject to regulation under the designated enactments and designated statutory instruments (including financial service providers whose business is subject to regulation by an Authority that performs functions in an EEA country that are comparable to the functions performed by the Bank under a designated enactment or designated statutory instrument) and also includes former regulated entities who were regulated for part of the levy period and “regulated entity” shall be construed accordingly; | ||

“impact category” has the meaning attributed to it in the Schedule hereto; | ||

“impact score” has the meaning attributed to it in the Schedule hereto; | ||

“associated company” in relation to a company or undertaking that comes within Category B1, B2, B3, B4, B5, B6 or B7 of the Schedule hereto (a “Category B Undertaking”), means a regulated financial service provider that is also a Category B Undertaking and is: | ||

(a) a subsidiary company of a Category B Undertaking, or | ||

(b) a company that is a subsidiary of a holding company, if a Category B Undertaking is also a subsidiary of such holding company, but neither the company or the Category B Undertaking is a subsidiary of the other, or | ||

(c) if the holding company as described in (b) above is itself a subsidiary, any other subsidiary of its ultimate holding company. | ||

3. (a) Subject to (b) and to Regulations 4 and 5, all persons who are, or have been, regulated entities during the levy period, shall, on or before the due date, pay the levy contribution, and supplementary levy contribution (if applicable), to the Bank. | ||

(b) Where a regulated entity has been subject to regulation by the Bank for part of the levy period only, then: | ||

(i) the levy contribution shall be calculated by reference to the number of days of the levy period during which the entity was regulated; and | ||

(ii) any supplementary levy contribution shall be applied on the basis set out in the Schedule. | ||

4. Where a regulated entity ceases to be subject to regulation during the subsequent Levy period and, other than this Regulation 4, Regulations have not been made under Section 32D of the Principal Act in respect of the subsequent levy period, then the Schedule shall apply with respect to that entity and the Bank shall issue a levy notice to such entity and: | ||

(i) the levy contribution shall be calculated by reference to the number of days of the subsequent levy period such entity was regulated; and | ||

(ii) any supplementary levy contribution shall be applied on the basis set out in the Schedule. | ||

5. Where a regulated entity becomes subject to regulation by the Bank during the levy period, it shall be required to pay a levy contribution. In such circumstances, the Bank shall issue a levy notice to such entity and the levy contribution shall be calculated by reference to the number of days remaining in the levy period from the date on which such entity becomes subject to regulation by the Bank. | ||

6. The Bank shall determine the appropriate category or categories in the Schedule that shall apply to a regulated entity. | ||

7. Where in the reasonable opinion of the Bank the obligation of a regulated entity to pay a levy contribution or part thereof, or a supplementary levy contribution or part thereof, would be likely to make that regulated entity insolvent, or, where the regulated entity is a sole trader, bankrupt, the Bank may waive the obligation of that regulated entity under these Regulations to pay a levy contribution or part thereof or a supplementary levy contribution or part thereof. The Bank may waive, reduce, or remit a levy contribution or part thereof, or a supplementary levy contribution or part thereof, in exceptional circumstances at the Bank’s discretion. | ||

8. A regulated entity is required to pay the levy contribution prescribed in the Schedule hereto whether or not a levy notice has been issued by the Bank under Regulation 9. | ||

9. Subject to Regulation 11, the Bank may send to a regulated entity a levy notice specifying: | ||

(a) the levy contribution assessed by the Bank to be payable by that regulated entity for the levy period, and | ||

(b) the due date for payment of the levy contribution. | ||

10. If no levy notice is received by a regulated entity setting out the levy contribution for such entity by 25th November 2015 then the 23rd December 2015 shall be the due date for the payment of the levy contribution by such regulated entity in accordance with these Regulations. | ||

11. Without prejudice to whether a levy notice issues setting out a levy contribution, where a supplementary levy contribution applies, a levy notice specifying the supplementary levy contribution will issue to a regulated entity. | ||

12. The levy contribution, supplementary levy contribution (if applicable) and any interest accrued in accordance with Regulation 14 shall be paid by a regulated entity by cheque, direct bank transfer or equivalent electronic transfer of funds to a bank account specified by the Bank, or as is otherwise specified by the Bank. | ||

13. (a) A regulated entity or former regulated entity may, no later than 21 days following a due date, submit an appeal under this Regulation in respect of the levy contribution and/or supplementary levy contribution payable by such entity. | ||

(b) An appeal must set out in writing the grounds of the appeal and should include, in particular, all supporting documentation or representations. | ||

(c) Payment or a receipt evidencing payment of that portion of the levy contribution or supplementary levy contribution that is not under appeal must be submitted with an appeal under this Regulation. | ||

(d) The Bank shall advise the regulated entity or former regulated entity concerned in writing of its determination of the appeal and details of any amount outstanding in respect of the disputed amount of levy contribution and/or supplementary levy contribution and the due date applicable for the payment of any outstanding levy contribution and/or supplementary levy contribution. | ||

14. Without prejudice to any other remedy available to the Bank, where a required levy contribution or supplementary levy contribution has not been received by the due date, interest shall accrue thereon in accordance with the provisions of the European Communities (Late Payment in Commercial Transactions) Regulations 2012 (S.I. 580 of 2012) or any amending or replacing legislation. | ||

15. Every sum payable by a regulated entity under these Regulations, including interest, for or on account of the Bank shall be recoverable by the Bank from that person as a simple contract debt in a court of competent jurisdiction. | ||

16. (a) Each regulated entity shall keep full and true records of all transactions which affect their liability under these Regulations and any related returns made; | ||

(b) A record kept by a person pursuant to paragraph (a) and, in the case of any such record that has been given by the person to another person, any copy thereof that is in the power or control of the first mentioned person shall be retained by that person for a period of 6 years from the date of the last transaction to which the record relates, provided that this Regulation shall not apply to records of a company that have been disposed of in accordance with section 305(1) of the Companies Act 1963 or section 707 of the Companies Act 2014 ; | ||

(c) No person shall, in purported compliance with a provision of these Regulations, provide an answer or explanation, make a statement or produce or deliver any return, certificate, balance sheet or other document which is false in a material particular; | ||

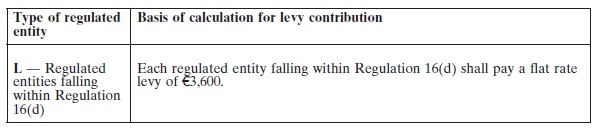

(d) A regulated entity that fails to comply with a provision of these Regulations or any applicable regulatory reporting requirements thereby preventing a full and proper assessment of their liability under these Regulations, may be assessed by the Bank in accordance with Category L of the Schedule hereto to determine a levy contribution, or may be otherwise assessed in a manner determined by the Bank, and the Bank may issue a levy notice to such a regulated entity, or former regulated entity, without prejudice to other actions which might be determined necessary or appropriate by the Bank in such circumstances. | ||

17. The Bank may exercise any of the powers and perform any of the functions and duties imposed on the Bank by these Regulations through or by any of the officers or employees of the Bank. | ||

18. These Regulations take effect on 7th October, 2015. | ||

| ||

Signed for and on behalf of the CENTRAL BANK COMMISSION, | ||

7 October 2015. | ||

CYRIL ROUX, | ||

Deputy Governor (Financial Regulator). | ||

| ||

SCHEDULE | ||

Levy Period: 1 January 2015 to 31 December 2015 | ||

CATEGORY A | ||

Credit Institutions | ||

| ||

| ||

CATEGORY B | ||

Insurance Undertakings | ||

| ||

Insurance Undertakings Groups | ||

| ||

CATEGORY C | ||

Intermediaries and Debt Management Firms | ||

| ||

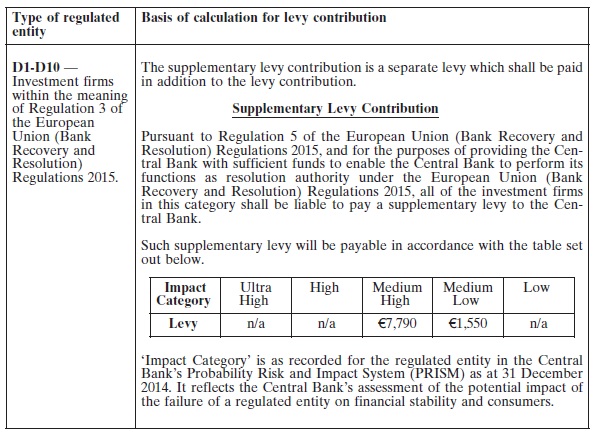

CATEGORY D | ||

Investment Firms | ||

(other than Investment Product Intermediaries) | ||

(Firms regulated under the provisions of either the Investment Intermediaries Act, 1995 or the European Communities (Markets in Financial Instruments) Regulations 2007) | ||

| ||

| ||

| ||

CATEGORY E | ||

Investment Funds, Alternative Investment Fund Managers and other Investment Fund Service Providers | ||

| ||

| ||

CATEGORY F | ||

Credit Unions | ||

| ||

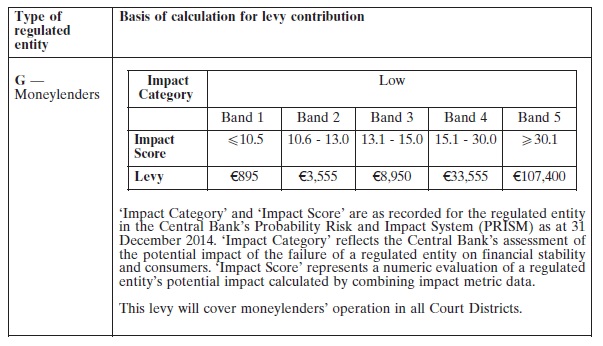

CATEGORY G | ||

Moneylenders | ||

| ||

CATEGORY H | ||

Approved Professional Bodies | ||

| ||

CATEGORY J | ||

Bureaux de Change | ||

| ||

CATEGORY L | ||

Default Assessments | ||

| ||

CATEGORY M | ||

Retail Credit Firms, Home Reversion Firms and Credit Servicing Firms | ||

| ||

CATEGORY N | ||

Payment Institutions and E-Money Institutions | ||

|