S.I. No. 95/2017 - Employment Permits Regulations 2017.

Notice of the making of this Statutory Instrument was published in | ||

“Iris Oifigiúil” of 31st March, 2017. | ||

I, MARY MITCHELL O’CONNOR, Minister for Jobs, Enterprise and Innovation, in exercise of the powers conferred on me by sections 10A, 14, 14A, 29 and 30 (as inserted or amended by sections 13 , 17 , 18 , 29 and 30 of the Employment Permits (Amendment) Act 2014 (No. 26 of 2014)) of the Employment Permits Act 2006 (No. 16 of 2006) (as adapted by the Enterprise, Trade and Innovation (Alteration of Name of Department and Title of Minister) Order 2011 ( S.I. No. 245 of 2011 )), hereby make the following regulations: | ||

Part 1 | ||

Preliminary | ||

Citation | ||

1. These Regulations may be cited as the Employment Permits Regulations 2017. | ||

Commencement | ||

2. These Regulations shall come into force on 3 April 2017. | ||

Interpretation | ||

3. In these Regulations— | ||

“Act of 2003” means the Employment Permits Act 2003 (No. 7 of 2003), as amended by the Act of 2014; | ||

“Act of 2014” means the Employment Permits (Amendment) Act 2014 (No. 26 of 2014); | ||

“carer in a private home” means a person who— | ||

(a) is a qualified medical professional and is caring for a person with a severe medical condition in a domestic dwelling, or | ||

(b) is caring for a person with special care needs in a domestic dwelling, in circumstances where— | ||

(i) he or she has a long history of caring for the person concerned, | ||

(ii) the relationship between the two persons is a significant aspect of the quality of care being provided, and | ||

(iii) there are no alternative care options; | ||

“Contract for Services Employment Permit” has the meaning assigned to it in Regulation 42; | ||

“Critical Skills Employment Permit” has the meaning assigned to it in Regulation 17; | ||

“Dependant/Partner/Spouse Employment Permit” has the meaning assigned to it in Regulation 22; | ||

“domestic operative” means any person, other than a carer in a private home, whose employment takes place principally in a private home; | ||

“EEA contractor” means a contractor whose principal place of business is located within a Member State of the EEA; | ||

“EURES” means the network of public employment services and partners within the Member States of the EEA; | ||

“Exchange Agreement Employment Permit” has the meaning assigned to it in Regulation 55; | ||

“fast food outlet” means a food establishment where food is prepared in bulk for speed of service, rather than to individual order; | ||

“General Employment Permit” has the meaning assigned to it in Regulation 28; | ||

“Internship Employment Permit” has the meaning assigned to it in Regulation 64; | ||

“Intra-Company Transfer Employment Permit” has the meaning assigned to it in Regulation 35; | ||

“P21” means the balancing statement of that name issued in respect of an employee by the Revenue Commissioners; | ||

“P30” means the monthly return of that name furnished by an employer to the Revenue Commissioners; | ||

“P45” means the document of that name issued by an employer in respect of an employee who has ceased employment with the employer; | ||

“P60” means the document of that name issued by an employer in respect of an employee for each year that he or she is in the employment of the employer; | ||

“pin” means personal identification number; | ||

“Principal Act” means the Employment Permits Act 2006 (No. 16 of 2006), as amended by the Act of 2014; | ||

“Reactivation Employment Permit” has the meaning assigned to it in Regulation 50; | ||

“registered medical practitioner” has the meaning assigned to it in section 2 of the Medical Practitioners Act 2007 (No. 25 of 2007); | ||

“restaurant” means any premises which are structurally adapted and used for the purpose of supplying substantial meals to the public for consumption on the premises and in which any other business carried on is ancillary and subsidiary to the provision of such meals; | ||

“Sport and Cultural Employment Permit” has the meaning assigned to it in Regulation 60; | ||

“Trusted Partner” means a person who has made an application under Part 2 and who the Minister has provided with a Trusted Partner Registration Number for use in subsequent employment permit applications; | ||

“Trusted Partner Registration” means registration pursuant to an application made under Part 2 whereby a person who will make an offer of employment, an employer, a connected person or an EEA contractor can provide the Minister with certain information required under the Principal Act in relation to their business, and as the case may be, connections or contract service agreements, in advance of such person, employer, connected person or EEA contractor making an application for an employment permit. | ||

“vacancy reference number” means the six digit identification number assigned to each vacancy added to the Jobs Ireland portal maintained by the Minister for Social Protection. | ||

Part 2 | ||

Trusted Partner Registration | ||

Application for Trusted Partner Registration | ||

4. (1) Applications for Trusted Partner Registration, whether made by electronic means or in paper form, shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) Where an application for Trusted Partner Registration is made by electronic means, the printed and signed application form shall also be submitted to the Minister. | ||

(3) The following information and documents are prescribed for the purpose of section 6(g)(i) of the Principal Act and shall be provided with an application for Trusted Partner Registration: | ||

(a) where the person who will make the offer of employment, or, as the case may be, the EEA contractor or connected person, has not yet made returns to the Revenue Commissioners in respect of employees, a statement in writing provided by the Revenue Commissioners confirming registration with the Revenue Commissioners and stating the said person’s ERN (Employer Registered Number), | ||

(b) in the case of an employer, or where the person who will make the offer of employment, or, as the case may be, the EEA contractor or connected person, does not come under subparagraph (a), a copy of— | ||

(I) a P30 returned to the Revenue Commissioners within the 3 month period preceding the application, or a receipt for such return, whether issued through ROS (Revenue Online Service) or otherwise, or | ||

(II) evidence of P30 SEPA monthly direct debit payments made within the 3 month period preceding the application, | ||

(c) where the person who will make the offer of employment, or, as the case may be, the employer or the connected person is operating a restaurant or fast food outlet— | ||

(I) if the establishment has been operating for one year or more, a copy of a “P35L” form returned by the person who will make the offer of employment, the employer or the connected person, to the Revenue Commissioners, | ||

(II) an up-to-date tax clearance certificate in respect of the person who will make the offer of employment, the employer or the connected person, | ||

(III) copies of utility bills for the establishment’s premises dated within the period of 2 months prior to the application, and | ||

(IV) a letter from the relevant official agency confirming that the person who will make the offer of employment, the employer or the connected person, has registered its premises in accordance with Article 6 of Regulation (EC) No. 852/2004 of the European Parliament and of the Council of 29 April 20041 and Regulation 6 of the European Communities (Hygiene of Foodstuffs) Regulations 2006 ( S.I. No. 369 of 2006 ), | ||

(d) where the person who will make the offer of employment or the employer is required to obtain permission from the Minister for Justice and Equality to operate a business in the State, a copy of the appropriate permission, | ||

(e) where the person who will make the offer of employment, or, as the case may be, the employer or the connected person has charitable status from the Revenue Commissioners, a letter from the Revenue Commissioners confirming that such person has such charitable status, | ||

(f) in respect of applications by connected persons, documentary evidence of the connection(s) between the connected person and the foreign employer(s), and | ||

(g) in respect of applications by EEA contractors, information and documentary evidence in relation to the contract service agreement(s) under which it is proposed that employees will be providing services. | ||

Time period of Trusted Partner Registration | ||

5. Trusted Partner Registration shall be for a period not exceeding 2 years, renewable by way of application pursuant to Regulation 6, and may be cancelled at any time by the Minister, including where— | ||

(a) information or a document provided under Regulation 4(3) is no longer valid or applicable, or | ||

(b) the person who will make the offer of employment, or, as the case may be, the EEA contractor or connected person, has been convicted of an offence under the Principal Act, the Act of 2003, the Immigration Act 2004 (No. 1 of 2004) or an enactment specified in Schedule 1 to the Principal Act. | ||

Application for renewal of Trusted Partner Registration | ||

6. (1) Applications for renewal of a Trusted Partner Registration, whether by electronic means or in paper form, shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) Where an application for renewal of a Trusted Partner Registration is made by electronic means, the printed and signed application form shall also be submitted to the Minister. | ||

(3) The following information and documents are prescribed for the purpose of section 6(g)(i) of the Principal Act and shall be provided with an application for renewal of a Trusted Partner Registration: | ||

(a) in respect of the person who will make the offer of employment, the employer, the connected person or the EEA contractor, a copy of— | ||

(I) a P30 returned to the Revenue Commissioners within the 3 month period preceding the application, or a receipt for such return, whether issued through ROS (Revenue Online Service) or otherwise, or | ||

(II) evidence of P30 SEPA monthly direct debit payments made within the 3 month period preceding the application | ||

(b) where the person who will make the offer of employment, or, as the case may be, the employer or the connected person, is operating a restaurant or fast food outlet an up-to-date tax clearance certificate in respect of the person who will make the offer of employment, the employer or the connected person, | ||

(c) where the person who will make the offer of employment or the employer is required to obtain permission from the Minister for Justice and Equality to operate a business in the State, a copy of the appropriate permission, | ||

(d) where the person who will make the offer of employment, or, as the case may be, the employer or the connected person has charitable status from the Revenue Commissioners, a letter from the Revenue Commissioners confirming that such person has such charitable status, | ||

(e) in respect of an application by a connected person, documentary evidence of the connection(s) between the connected person and the foreign employer(s), and | ||

(f) in respect of an application by an EEA contractor, information and documentary evidence in relation to the contract service agreement(s) under which it is proposed that employees will be providing services. | ||

Part 3 | ||

General provisions | ||

Fees | ||

7. (1) Subject to paragraphs (4) and (5), the fees listed in Schedule 1 are prescribed in respect of the applications described therein. | ||

(2) Payment of fees under these Regulations and the Principal Act shall be made— | ||

(a) where the application is made in paper form, in the form of a Euro denominated cheque, bank draft, demand draft or postal order, drawn on a financial institution operating within the Irish clearing system and made payable to the Department of Jobs, Enterprise and Innovation, or by electronic transfer to an account of the Department of Jobs, Enterprise and Innovation, specified from time to time for this purpose by the Minister, or | ||

(b) where application is made by electronic means, in the form of electronic credit or debit card payment. | ||

(3) A portion of up to 90% is prescribed, for the purpose of section 12(5) of the Principal Act, as the portion of a fee that may be returned in the event of an application being refused or withdrawn. | ||

(4) No fee shall be payable where the application is made by the person who has made the offer of employment, or, as the case may be, the employer or the connected person, and such person— | ||

(a) provides with the application a letter from the Revenue Commissioners confirming that such person has charitable status, or | ||

(b) has provided the letter referred to in subparagraph (a) in respect of a different application, and in respect of which an employment permit was granted or renewed, within the 12 month period preceding the application. | ||

(5) No fee shall be payable where the foreign national in respect of whom the application is made is the spouse or civil partner of a person who is a national of a Member State of the EEA, provided that the application is accompanied by— | ||

(a) clear copies of the relevant pages of the current passport of the spouse or civil partner of the foreign national in respect of whom the application is made, showing his or her picture, personal details and signature, and | ||

(b) a copy of the relevant marriage certificate or civil partnership registration. | ||

Application for grant of employment permit | ||

8. (1) Applications made for the grant of employment permits, whether made by electronic means or in paper form, shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) The following information and documents are prescribed for the purpose of section 6(g)(i) of the Principal Act and shall be provided with an application for the grant of an employment permit: | ||

(a) where an application is made— | ||

(I) in paper form, a photograph, or | ||

(II) by electronic means, a digital passport photograph in jpeg format, | ||

of the foreign national in respect of whom the application is made, of the same size and form as the photograph required by the Minister for Foreign Affairs and Trade to be contained in a passport issued by that Minister to a citizen of the State; | ||

(b) clear copies of the relevant pages of the passport of the foreign national in respect of whom the application is made, showing his or her picture, personal details, passport expiry date 12 months or more after the date of application, and his or her signature; | ||

(c) a clear copy of the current immigration stamp and visa, if applicable, of the foreign national in respect of whom the application is made or, if available, his or her Garda National Immigration Bureau pin; | ||

(d) in the case of an application for employment in a profession listed in Part A of Schedule 2, a copy of the registration of the foreign national in respect of whom the application is made with the appropriate regulatory body listed in that Schedule or, if available, his or her registration number, licence number or pin with that regulatory body; | ||

(e) in the case of an application for employment in a profession listed in Part B or Part C of Schedule 2, a copy of the registration or recognition of qualifications of the foreign national in respect of whom the application is made with the appropriate regulatory body or Minister of the Government listed in that Schedule; | ||

(f) in the case of an application for employment as a carer in a private home— | ||

(I) copies of qualifications confirming that the foreign national in respect of whom the application is made is a trained medical professional in a profession listed in Part A of Schedule 2 and a letter from a registered medical practitioner specialising in the area of illness of the person for whom the foreign national will be caring, confirming that that person has a severe medical condition, or | ||

(II) a copy of a P60, payslips, a notarised letter or an affidavit establishing that the foreign national in respect of whom the application is made has a long history of caring for the person concerned and a letter from a registered medical practitioner specialising in the area of illness of the person for whom the foreign national will be caring confirming that that person has special care needs; | ||

(g) in the case of an application for employment in a restaurant or fast food outlet— | ||

(I) copies of any certified qualifications of the foreign national in respect of whom the application is made, and | ||

(II) in the case of an application for a Critical Skills Employment Permit, General Employment Permit, Sport and Cultural Employment Permit or Intra-Company Transfer Employment Permit in respect of employment as— | ||

(A) an executive chef, | ||

(B) a head chef, | ||

(C) a sous chef, or | ||

(D) a specialist chef, | ||

specialising in cuisine originating from a state that is not a Member State of the EEA, a statement from the person who makes the offer of employment, or the connected person, confirming that the foreign national in respect of whom the application is made shall be employed in an establishment other than a fast food outlet; | ||

(h) where applicable, a copy of the registration, held by the foreign national in respect of whom the application is made, with the American Institute of Certified Public Accountants (AICPA), the Philippine Institute of Certified Public Accountants (PICPA) or the Institute of Chartered Accountants of Pakistan (ICAP); | ||

(i) in the case of an application for employment as a heavy goods vehicle driver, a copy of the category CE or C1E driving licence held by the foreign national in respect of whom the application is made; | ||

(j) in the case of an application for employment as a nurse or midwife on completion of the Clinical Adaptation and Assessment Programme or the RCSI (Royal College of Surgeons of Ireland) Examination, as the case may be, evidence of permission from the Minister for Justice and Equality given to the foreign national to remain in the State for the purpose of completion of the programme or examination, and to subsequently apply for an employment permit; and | ||

(k) where the application is made by electronic means, copies of signed declarations as may be required. | ||

(3) In addition to the information and documents prescribed under paragraph (2), the following information and documents are prescribed for the purpose of section 6(g)(i) of the Principal Act and shall be provided with an application made for the grant of an employment permit, other than an application made by a Trusted Partner: | ||

(a) where the person who makes the offer of employment, or, as the case may be, the contractor or connected person, has not yet made returns to the Revenue Commissioners in respect of employees, a statement in writing provided by the Revenue Commissioners confirming registration with the Revenue Commissioners and stating the said person’s ERN (Employer Registered Number); | ||

(b) where the person who makes the offer of employment, or, as the case may be, the contractor or connected person, does not come under subparagraph (a) and has not provided one of the following documents in respect of a different application, and in respect of which an employment permit was granted or renewed, within the 12 months preceding the application, a copy of— | ||

(I) a P30 returned to the Revenue Commissioners within the 3 month period preceding the application, or a receipt for such return, whether issued through ROS (Revenue Online Service) or otherwise, or | ||

(II) evidence of P30 SEPA monthly direct debit payments made within the 3 month period preceding the application; | ||

(c) where the person who makes the offer of employment is required to obtain permission from the Minister for Justice and Equality to operate a business in the State, a copy of the appropriate permission; and | ||

(d) in the case of an application for employment in a restaurant or fast food outlet— | ||

(I) if the establishment has been operating for one year or more, a copy of a “P35L” form returned by the person who makes the offer of employment, or the connected person, to the Revenue Commissioners, | ||

(II) an up-to-date tax clearance certificate in respect of the person who makes the offer of employment, or the connected person, | ||

(III) copies of utility bills for the establishment’s premises dated within the period of 2 months prior to the application, and | ||

(IV) a letter from the relevant official agency confirming that the person who makes the offer of employment, or the connected person, has registered its premises in accordance with Article 6 of Regulation (EC) No. 852/2004 of the European Parliament and of the Council of 29 April 20042 and Regulation 6 of the European Communities (Hygiene of Foodstuffs) Regulations 2006 ( S.I. No. 369 of 2006 ). | ||

Application for renewal of employment permit | ||

9. (1) Applications for the renewal of the employment permits, whether made by electronic means or in paper form, shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) The following information, documents and evidence are prescribed for the purpose of section 20(4A) of the Principal Act and shall be provided with an application for the renewal of an employment permit: | ||

(a) where an application is made— | ||

(I) in paper form, a photograph, or | ||

(II) by electronic means, a digital passport photograph in jpeg format, | ||

of the permit holder, of the same size and form as the photograph required by the Minister for Foreign Affairs and Trade to be contained in a passport issued by that Minister to a citizen of the State; | ||

(b) clear copies of the relevant pages of the permit holder’s passport, showing his or her picture, personal details, a passport expiry date of 3 months or more after the date of application for renewal and his or her signature; | ||

(c) a clear copy of the permit holder’s current immigration stamp and visa if applicable, or, if available, his or her Garda National Immigration Bureau pin; | ||

(d) a copy of 3 recent payslips of the permit holder dated within the 4 month period prior to the application; | ||

(e) a copy of the P60 issued in respect of the permit holder for each year that he or she has been employed pursuant to the employment permit, or, if the P60 is not available, the P21 issued in respect of the permit holder; | ||

(f) in the case of an application for employment in a profession listed in Part A of Schedule 2, a copy of the permit holder’s registration with the appropriate regulatory body listed in that Schedule or, if available, his or her registration number, licence number or pin with that regulatory body; | ||

(g) in the case of an application for employment in a profession listed in Part B or Part C of Schedule 2, a copy of the permit holder’s registration with, or recognition of qualifications by, the appropriate regulatory body or Minister of Government listed in that Schedule; | ||

(h) in the case of an application for employment in a restaurant or fast food outlet an up-to-date tax clearance certificate in respect of the employer or the connected person; | ||

(i) where applicable, a copy of the permit holder’s registration with the American Institute of Certified Public Accountants (AICPA), the Philippine Institute of Certified Public Accountants (PICPA) or the Institute of Chartered Accountants of Pakistan (ICAP); | ||

(j) in the case of an application for employment as a heavy goods vehicle driver, a copy of the permit holder’s category CE or C1E driving licence; and | ||

(k) where the application is made by electronic means, copies of signed declarations as may be required. | ||

(3) In addition to the information and documents prescribed under paragraph (2), the following information and documents are prescribed for the purpose of section 20(4A) of the Principal Act and shall be provided with an application made for the renewal of an employment permit, other than an application made by a Trusted Partner: | ||

(a) in the case of an employer, or, as the case may be, a contractor or connected person, who has not provided one of the following documents in respect of a different application, and in respect of which an employment permit was granted or renewed, within the 12 months preceding the application, a copy of— | ||

(I) a P30 returned to the Revenue Commissioners within the 3 month period preceding the application, or a receipt for such return, whether issued through ROS (Revenue Online Service) or otherwise, or | ||

(II) evidence of P30 SEPA monthly direct debit payments made within the 3 month period preceding the application; and | ||

(b) where the person who makes the offer of employment is required to obtain permission from the Minister for Justice and Equality to operate a business in the State, a copy of the appropriate permission. | ||

(4) For the purpose of section 20(2) of the Principal Act, an application for the renewal of an employment permit shall be made— | ||

(a) within the period of 4 months ending on the day of expiry of the period for which it has been granted (or for which it has last been renewed under that section), or | ||

(b) within the period of 1 month after the expiry of that period. | ||

Time period after offer of employment or publication of notice within which application must be made | ||

10. The period of 90 days is prescribed— | ||

(a) in the case of an application for an employment permit to which section 10A(5) of the Principal Act applies, as the number of days from the day on which a notice is first published in accordance with that section, within which such application must be made, and | ||

(b) in the case of an application for any other employment permit, as the period preceding the application within which an offer of employment in the State must have been made to the foreign national in respect of whom the application is made. | ||

Time period for submission of additional information, documents or evidence | ||

11. The period within which information, documents or evidence requested by the Minister must be provided is the period of 28 days after the date of the request. | ||

Declarations | ||

12. The Minister may, subject to a right of verification in all cases, consider any requirement specified in the Principal Act or these Regulations to be satisfied by a declaration made by the relevant parties in such form as may be provided or required for that purpose by the Minister and made available online at www.djei.ie. | ||

Change of name following transfer of undertaking | ||

13. (1) Notification of a change of name to which section 8(8) of the Principal Act applies shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) In the event of a change of name to which section 8(8) of the Principal Act applies, the following information and documents shall be provided with the notification referred to in paragraph (1): | ||

(a) the original and the certified copy of the employment permit to be amended; | ||

(b) a letter from a solicitor or accountant confirming— | ||

(i) that the transfer comes within the meaning of the European Communities (Protection of Employees on Transfer of Undertakings) Regulations 2003 ( S.I. No. 131 of 2003 ), and | ||

(ii) the date of the transfer; and | ||

(c) one of the following documents: | ||

(i) a P30 returned by the new employer, or as the case may be, the new contractor or new connected person, within the 3 month period preceding the notification of change of name, or a receipt for such return, whether issued through ROS (Revenue Online Service) or otherwise, | ||

(ii) evidence of P30 SEPA monthly direct debit payments made within the 3 month period preceding the application, or | ||

(iii) where the new employer, or, as the case may be, the new contractor or new connected person, has not yet made returns to the Revenue Commissioners in respect of employees, a statement in writing provided by the Revenue Commissioners confirming registration with the Revenue Commissioners and stating the said person’s ERN (Employer Registered Number). | ||

Redundancy | ||

14. (1) Notification to be made by a foreign national in the event of a redundancy to which section 20A or 20B of the Principal Act applies shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) In addition to the information and documentation referred to in section 20C of the Principal Act, the foreign national concerned shall provide to the Minister, with the notification to be made under such section: | ||

(a) a letter from the employer specified in the employment permit confirming that the foreign national has been dismissed by reason of redundancy, and | ||

(b) where available, the P45 issued to the foreign national following his or her redundancy. | ||

Registration with regulatory body or Minister of Government | ||

15. (1) Subject to paragraph (2), a foreign national in respect of whom an application is made for an employment permit for employment in a profession listed in Part C of Schedule 2 is required to be registered with, or have his or her qualifications recognised by, the corresponding regulatory body or Minister of Government listed in that Part. | ||

(2) Paragraph (1) shall not apply to foreign nationals in the following employments: | ||

(a) qualified accountants with at least three years’ auditing experience, who are full members of the American Institute of Certified Public Accountants (AICPA), the Philippine Institute of Certified Public Accountants (PICPA) or the Institute of Chartered Accountants of Pakistan (ICAP) and who have relevant work experience in the areas of US GAAP reporting and Global Audit and Advisory Services, and where the employment concerned is in MNC Global Audit Services; and | ||

(b) tax consultants specialising in non-EEA tax consultancy and compliance with a professional tax qualification or legal qualification with tax specialism, who have a minimum of three years’ experience of tax consultancy requirements and regulations in the relevant non-EEA market. | ||

Review of decision to refuse or revoke employment permit | ||

16. (1) An application to submit a decision for review under section 13 or 17 of the Principal Act shall be in the relevant form for the time being provided for that purpose by the Minister and made available online at www.djei.ie. | ||

(2) An application for review of a decision under section 13 or 17 of the Principal Act shall be accompanied by— | ||

(a) the letter which issued from the Department of Jobs, Enterprise and Innovation advising the applicant of the Minister’s decision to refuse the employment permit application under section 12 of the Principal Act, or | ||

(b) the letter which issued from the Department of Jobs, Enterprise and Innovation advising the holder of the employment permit and the employer, or connected person, of the decision to revoke the employment permit under section 16 of the Principal Act, | ||

as well as by any other relevant documentation in support of the request for review of the decision. | ||

Part 4 | ||

Critical Skills Employment Permit | ||

Name and purpose of Critical Skills Employment Permit | ||

17. The name of the employment permit granted for the purpose referred to in section 3A(2)(a) of the Principal Act shall be the ‘Critical Skills Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Critical Skills Employment Permit | ||

18. (1) The employments for which a Critical Skills Employment Permit may be granted are— | ||

(a) the employments listed in Schedule 3 for which the minimum annual remuneration is €30,000 and in respect of which the minimum hourly rate of remuneration is €14.79, and | ||

(b) all other employments, other than the employments listed in Schedule 4, for which the minimum annual remuneration is €60,000 and in respect of which the minimum hourly rate of remuneration is €29.58. | ||

Minimum number of hours of work under Critical Skills Employment Permit | ||

19. The minimum number of hours of work required to be worked each week under a Critical Skills Employment Permit is 20. | ||

Qualification or experience required for Critical Skills Employment Permit | ||

20. (1) In the case of a Critical Skills Employment Permit for an employment for which the minimum annual remuneration is €60,000, the qualification or experience required in respect of that employment is— | ||

(a) a third level degree relevant to the employment concerned, or | ||

(b) the necessary experience. | ||

(2) In the case of a Critical Skills Employment Permit for an employment for which the minimum annual remuneration is €30,000, the qualification required in respect of that employment is a third level degree relevant to the employment concerned. | ||

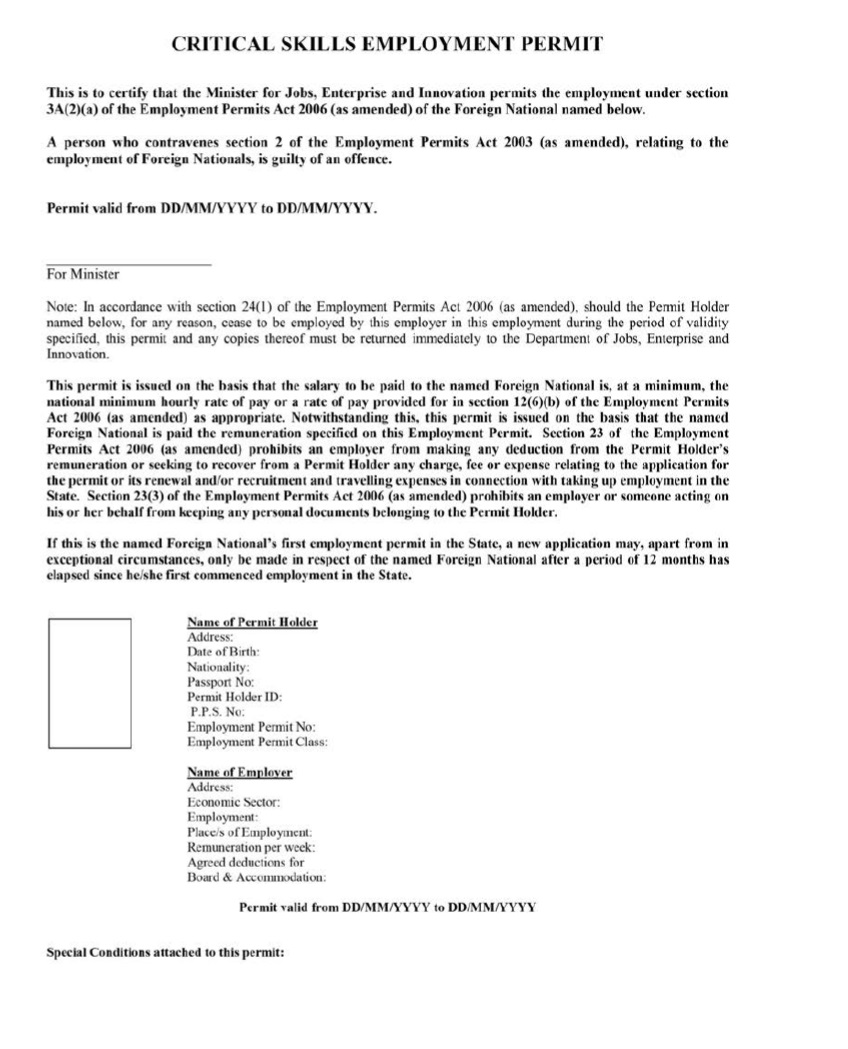

Form of Critical Skills Employment Permit | ||

21. Form A in Schedule 6 is prescribed as the form of a Critical Skills Employment Permit. | ||

Part 5 | ||

Dependant/Partner/Spouse Employment Permit | ||

Name and purpose of Dependant/Partner/Spouse Employment Permit | ||

22. The name of the employment permit granted for the purpose referred to in section 3A(2)(b) of the Principal Act shall be the ‘Dependant/Partner/Spouse Employment Permit’. | ||

Eligible employments and minimum hourly rate of remuneration for Dependant/Partner/Spouse Employment Permit | ||

23. (1) Subject to paragraph (2), the employments for which a Dependant/Partner/Spouse Employment Permit may be granted are all employments, other than that of a domestic operative. | ||

(2) The minimum hourly rate of remuneration for which a Dependant/Partner/Spouse Employment Permit may be granted is the rate— | ||

(a) declared by order under section 10D(1) (inserted by section 8 of the National Minimum Wage (Low Pay Commission) Act 2015 (No. 22 of 2015)) of the National Minimum Wage Act 2000 (No. 5 of 2000), or | ||

(b) where applicable, provided for in an employment regulation order made under section 42C(2) (inserted by section 12 of the Industrial Relations (Amendment) Act 2012 (No. 32 of 2012)) of the Industrial Relations Act 1946 (No. 26 of 1946), | ||

whichever is the higher. | ||

Documentation required for grant of Dependant/Partner/Spouse Employment Permit | ||

24. (1) In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, for the purpose of section 6(g)(i) of the Principal Act, the following documents shall be provided with an application for the grant of a Dependant/Partner/Spouse Employment Permit to a foreign national referred to in section 3C(2) of the Principal Act: | ||

(a) a copy of a birth certificate, marriage certificate, civil partnership registration, evidence of permission from the Minister for Justice and Equality to remain in the State for the purpose of making an application for an employment permit, or other legal document evidencing the relationship of the dependant, civil partner or spouse with the primary permit holder; | ||

(b) clear copies of the relevant pages of the primary permit holder’s current passport, showing his or her picture, personal details, passport expiry date and signature; | ||

(c) clear copies of the primary permit holder’s current immigration stamp or visa, or, if available, his or her Garda National Immigration Bureau pin; and | ||

(d) a letter from the primary permit holder’s employer, dated within the 3 month period prior to the application, confirming the primary permit holder’s employment with that employer and his or her job title. | ||

(2) In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, for the purpose of section 6(g)(i) of the Principal Act, the following documents shall be provided with an application for the grant of a Dependant/Partner/Spouse Employment Permit to a foreign national referred to in section 3C(3) of the Principal Act: | ||

(a) a copy of a birth certificate, marriage certificate, civil partnership registration, evidence of permission from the Minister for Justice and Equality to remain in the State for the purpose of making an application for an employment permit, or other legal document evidencing the dependant, civil partner or spouse’s relationship with the research project researcher; | ||

(b) clear copies of the relevant pages of the research project researcher’s current passport, showing his or her picture, personal details, passport expiry date and signature; | ||

(c) clear copies of the research project researcher’s current immigration stamp or visa, or, if available, his or her Garda National Immigration Bureau pin; | ||

(d) in the case of a foreign national referred to in section 3C(3)(a) of the Principal Act, a letter from the person in the State with whom the research is being carried out, dated within the 3 month period prior to the application, confirming that the research project researcher is carrying out such research; and | ||

(e) in the case of a foreign national referred to in section 3C(3)(b) of the Principal Act, a letter from the employer of the research project researcher dated within the 3 month period prior to the application, confirming the research project researcher’s employment with that employer and his or her job title. | ||

Documentation required for renewal of Dependant/Partner/Spouse Employment Permit | ||

25. (1) In addition to the information, documents and evidence prescribed under paragraphs (2) and (3) of Regulation 9, as applicable, for the purpose of section 20(4A) of the Principal Act, an application for the renewal of a Dependant/Partner/Spouse Employment Permit granted to a foreign national referred to in section 3C(2) of the Principal Act shall be accompanied by— | ||

(a) clear copies of the relevant pages of the primary permit holder’s current passport, showing his or her picture, personal details, passport expiry date and signature, | ||

(b) clear copies of the primary permit holder’s current immigration stamp or visa or, if available, his or her Garda National Immigration Bureau pin, and | ||

(c) a letter from the primary permit holder’s employer, dated within the 3 month period prior to the application, confirming the primary permit holder’s employment with that employer. | ||

(2) In addition to the information, documents and evidence prescribed under paragraphs (2) and (3) of Regulation 9, as applicable, for the purpose of section 20(4A) of the Principal Act, an application for the renewal of a Dependant/Partner/Spouse Employment Permit granted to a foreign national referred to in section 3C(3) of the Principal Act shall be accompanied by— | ||

(a) clear copies of the relevant pages of the research project researcher’s current passport, showing his or her picture, personal details, passport expiry date and signature, | ||

(b) clear copies of the research project researcher’s current immigration stamp or visa or, if available, his or her Garda National Immigration Bureau pin, | ||

(c) in the case of a foreign national referred to in section 3C(3)(a) of the Principal Act, a letter from the person in the State with whom the research is being carried out, dated within the 3 month period prior to the application, confirming that the research project researcher is carrying out such research, and | ||

(d) in the case of a foreign national referred to in section 3C(3)(b) of the Principal Act, a letter from the employer of the research project researcher, dated within the 3 month period prior to the application, confirming the research project researcher’s employment with that employer and his or her job title. | ||

Minimum number of hours of work under Dependant/Partner/Spouse Employment Permit | ||

26. The minimum number of hours of work required to be worked each week under a Dependant/Partner/Spouse Employment Permit is 10. | ||

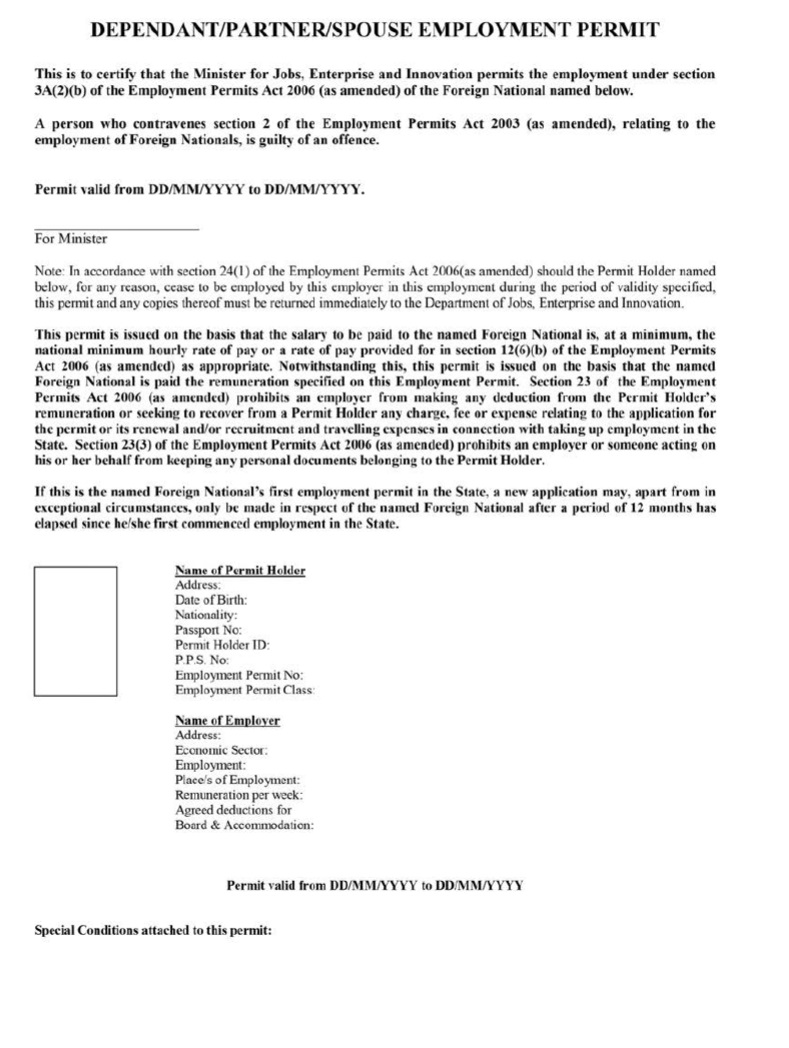

Form of Dependant/Partner/Spouse Employment Permit | ||

27. Form B in Schedule 6 is prescribed as the form of a Dependant/Partner/Spouse Employment Permit. | ||

Part 6General Employment Permit | ||

Name and purpose of General Employment Permit | ||

28. The name of the employment permit granted for the purpose referred to in section 3A(2)(c) of the Principal Act shall be the ‘General Employment Permit’. | ||

Eligible employments and minimum annual remuneration for General Employment Permit | ||

29. (1) Subject to paragraph (2), the employments for which a General Employment Permit may be granted are all employments, other than the employments listed in Schedule 4, for which— | ||

(a) in the case of a foreign national who has graduated in the last 12 months from a third level institution in the State and has been offered a graduate position in an employment listed in Schedule 3, the minimum annual remuneration is €27,000 and in respect of which the minimum hourly rate of remuneration is €13.31, | ||

(b) in the case of a foreign national who has graduated in the last 12 months from a third level institution outside the State and has been offered a graduate position in an employment listed under ‘ICT professionals’ in Schedule 3, the minimum annual remuneration is €27,000 and in respect of which the minimum hourly rate of remuneration is €13.31, | ||

(c) in the case of employment of a person fluent in the official language of a state which is not a Member State of the EEA, where the employment is supported by an enterprise development agency and the employment is in— | ||

(i) a customer service and sales role with relevant product knowledge, | ||

(ii) a specialist online digital marketing and sales role, or | ||

(iii) a specialist language support and technical sales support role, | ||

the minimum annual remuneration is €27,000 and in respect of which the minimum hourly rate of remuneration is €13.31, or | ||

(d) in the case of employment as a boner (meat), the minimum annual remuneration is €27,500 and in respect of which the minimum hourly rate of remuneration is €13.56, or | ||

(e) in any other case, the minimum annual remuneration is €30,000 and in respect of which the minimum hourly rate of remuneration is €14.79. | ||

(2) In the case of a General Employment Permit granted in respect of employment referred to in paragraph (1)(a) or (b), the minimum annual remuneration required as a condition of the renewal of such permit shall be €30,000 and in respect of which the minimum hourly rate of remuneration is €14.79. | ||

Maximum number of General Employment Permits for certain employments | ||

30. (1) The maximum number of General Employment Permits that may be granted in respect of employment as a boner (meat) is 160 and the period during which that maximum number shall be granted is the period up until that maximum number of permits is granted. | ||

(2) The maximum number of General Employment Permits that may be granted in respect of employment as a heavy goods vehicle driver who has a category CE or C1E driving licence is 120 and the period during which that maximum number shall be granted is the period up until that maximum number of permits is granted. | ||

Notice of offer of employment prior to application for General Employment Permit | ||

31. (1) In the case of an application for a General Employment Permit, the notice referred to in section 10A(3) of the Principal Act shall be placed— | ||

(a) with the Minister for Social Protection for publication on the EURES website for a minimum period of 14 days, | ||

(b) in at least one national newspaper for a minimum period of 3 days, and | ||

(c) either— | ||

(i) in a newspaper referred to in section 10A(4)(a)(iii)(I), or | ||

(ii) on a website referred to in section 10A(4)(a)(iii)(II), | ||

for a minimum period, in either case, of 3 days. | ||

(2) In the case of an application for a General Employment Permit, the notice referred to in section 10A(3) of the Principal Act shall contain— | ||

(a) a description of the employment, | ||

(b) the name of the person who shall make the offer of employment, | ||

(c) the minimum annual remuneration of the employment, | ||

(d) the location(s) at which the employment is to be carried out, and | ||

(e) the hours of work of the employment. | ||

(3) In the case of an application for a General Employment Permit, the employments referred to in section 10A(7)(a) of the Principal Act, to which the requirement to publish a notice under section 10A(2) of the Principal Act shall not apply, are— | ||

(a) the employments listed in Schedule 3, and | ||

(b) all other employments, other than the employments listed in Schedule 4, for which the minimum annual remuneration is €60,000. | ||

Information required for grant of General Employment Permit | ||

32. Where a notice of offer of employment has, in accordance with section 10A of the Principal Act, been required to be published, in addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, for the purpose of section 6(g)(i) of the Principal Act, the following information and documents shall be provided with an application for the grant of a General Employment Permit, other than an application in respect of an employment referred to in Regulation 31(3): | ||

(a) the vacancy reference number of the notice referred to in Regulation 31(1)(a), and | ||

(b) copies of the notices referred to in Regulation 31(1)(b) and (c), clearly showing the dates of publication of such notices. | ||

Minimum number of hours of work under General Employment Permit | ||

33. The minimum number of hours of work required to be worked each week under a General Employment Permit is 20. | ||

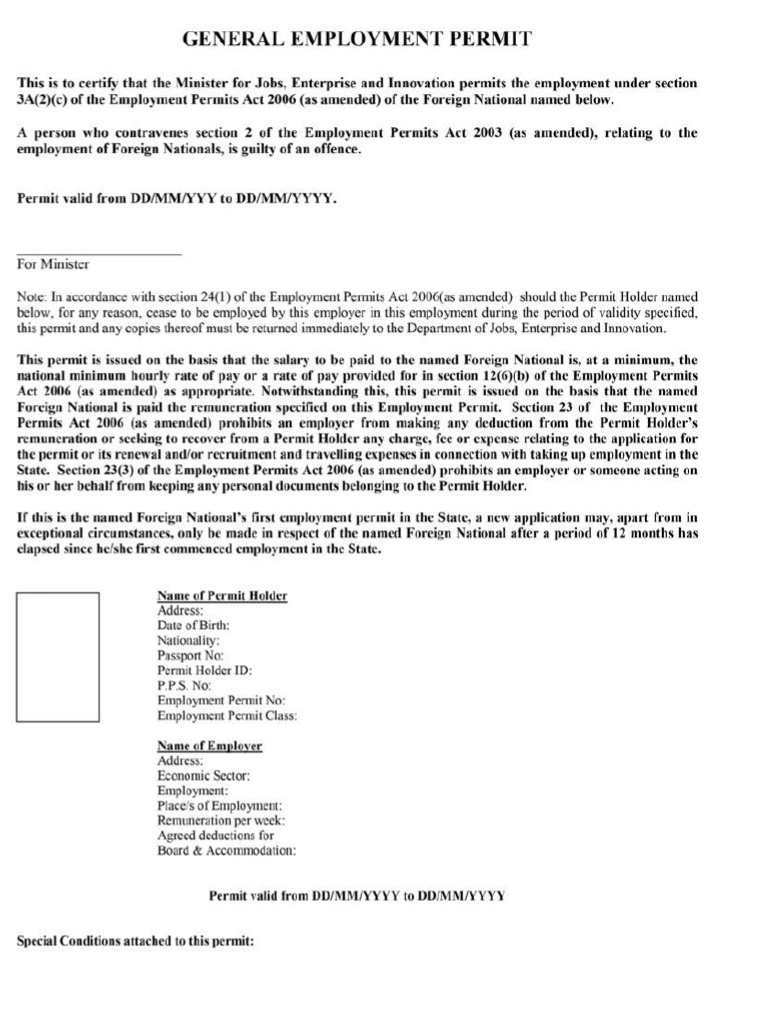

Form of General Employment Permit | ||

34. Form C in Schedule 6 is prescribed as the form of a General Employment Permit. | ||

Part 7 | ||

Intra-Company Transfer Employment Permit | ||

Name and purpose of Intra-Company Transfer Employment Permit | ||

35. The name of the employment permit granted for the purpose referred to in section 3A(2)(d) of the Principal Act shall be the ‘Intra-Company Transfer Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Intra-Company Transfer Employment Permit | ||

36. (1) Subject to paragraph (2), the employments for which an Intra-Company Transfer Employment Permit may be granted are— | ||

(a) in respect of the employments referred to in section 3A(2)(d)(i) of the Principal Act, employments— | ||

(i) in a senior management position, or | ||

(ii) in a position that requires specialist knowledge, qualifications or experience essential to the connected person’s service, research equipment, techniques or management, | ||

and for which the minimum annual remuneration is €40,000 and in respect of which the minimum hourly rate of remuneration is €19.72, and | ||

(b) in respect of the employments referred to in section 3A(2)(d)(ii) of the Principal Act, employments— | ||

(i) that require the foreign national in respect of whom the application is made to undergo training with the connected person for a period not exceeding 12 months, and | ||

(ii) for which the minimum annual remuneration is €30,000 and in respect of which the minimum hourly rate of remuneration is €14.79. | ||

(2) An Intra-Company Transfer Employment Permit shall not be granted in respect of an employment listed in Schedule 4. | ||

(3) In this Regulation “senior management position” means any position primarily having one of the following functions: | ||

(a) the management of the organisation, or a department, subdivision, function or component thereof, | ||

(b) the supervision or control of the work of other supervisory, professional or managerial staff, or management of an essential function within the organisation, or a department or subdivision thereof, | ||

(c) the authority to hire and terminate staff, or recommend same, as well as other human resources functions, or | ||

(d) the exercise of discretion over the day-to-day operations of the activity or function for which the foreign national has authority. | ||

Documentation required for grant of Intra-Company Transfer Employment Permit | ||

37. In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, for the purpose of section 6(g)(i) of the Principal Act, an application for the grant of an Intra-Company Transfer Employment Permit by a connected person who has not provided such documents in respect of a different application, and in respect of which an Intra-Company Transfer Employment Permit was granted or renewed, within the last 2 years shall be accompanied by documentary evidence of the connection between the connected person and the foreign employer. | ||

Minimum number of hours of work under Intra-Company Transfer Employment Permit | ||

38. The minimum number of hours of work required to be worked each week under an Intra-Company Transfer Employment Permit is 20. | ||

Minimum period of employment with foreign employer required for Intra-Company Transfer Employment Permit | ||

39. The minimum period of employment for which a foreign national referred to in section 3D(5) of the Principal Act shall be employed by the foreign employer before an application for an Intra-Company Transfer Employment Permit may be made in respect of him or her is— | ||

(a)6 months in the case of a foreign national referred to in section 3A(2)(d)(i) of the Principal Act, or | ||

(b)1 month in the case of a foreign national referred to in section 3A(2)(d)(ii) of the Principal Act. | ||

Remuneration documentation required for application for renewal of Intra-Company Transfer Employment Permit | ||

40. In addition to the information, documents and evidence prescribed in paragraphs (2) and (3) of Regulation 9, as applicable, the following shall be provided, and where necessary translated, with an application for the renewal of an Intra-Company Transfer Employment Permit: | ||

(a) documentation evidencing any payments made in respect of the board or accommodation of the holder of the employment permit; | ||

(b) documentation evidencing any payments made in respect of the health insurance of the holder of the employment permit; and | ||

(c) certified translations into English or Irish of any documentation referred to in paragraph (a) or (b), wherever such documentation is not in English or Irish. | ||

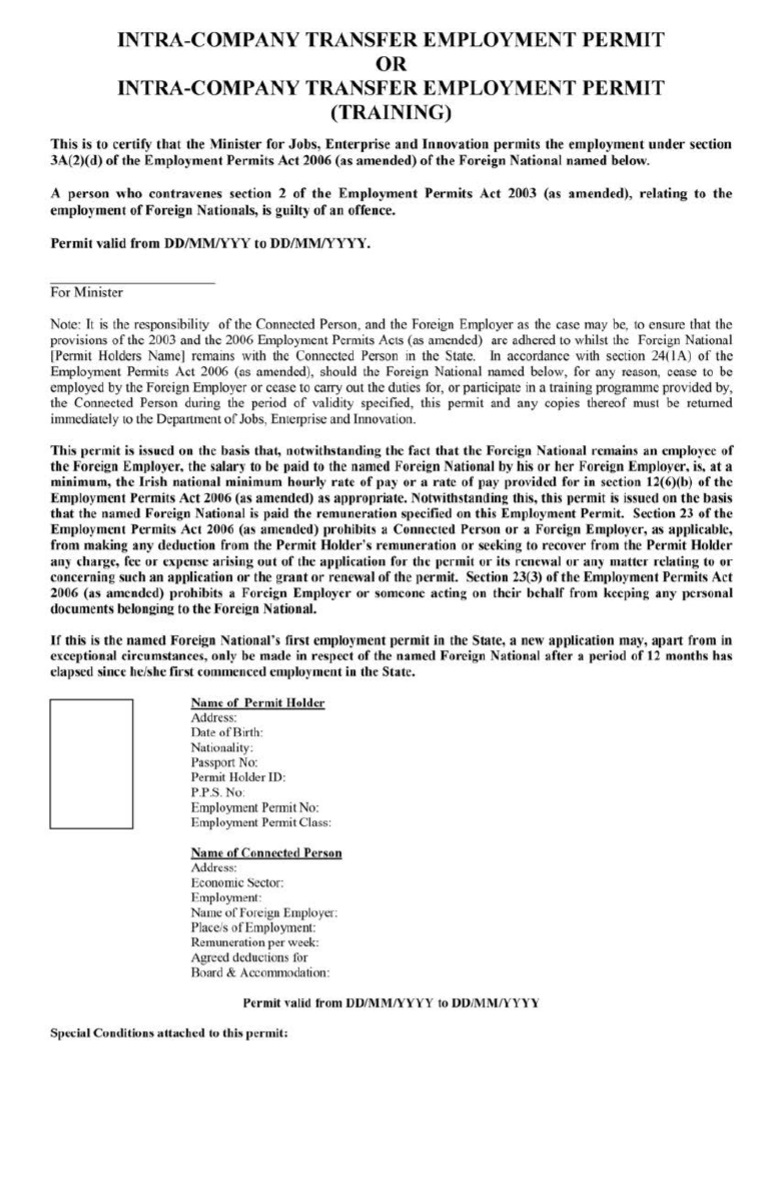

Form of Intra-Company Transfer Permit | ||

41. Form D in Schedule 6 is prescribed as the form of an Intra-Company Transfer Employment Permit. | ||

Part 8 | ||

Contract for Services Employment Permit | ||

Name and purpose of Contract for Services Employment Permit | ||

42. The name of the employment permit granted for the purpose referred to in section 3A(2)(e) of the Principal Act shall be the ‘Contract for Services Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Contract for Services Employment Permit | ||

43. (1) Subject to paragraph (2), the employments for which a Contract for Services Employment Permit may be granted are all employments, for which the minimum annual remuneration is €40,000 and in respect of which the minimum hourly rate of remuneration is €19.72. | ||

(2) A Contract for Services Employment Permit shall not be granted in respect of— | ||

(a) the employments listed in Schedule 4, and | ||

(b) employment as an executive chef, head chef, sous chef or specialist chef specialising in cuisine originating from a state that is not a Member State of the EEA, in an establishment other than a fast food outlet. | ||

Notice of offer of employment prior to application for Contract for Services Employment Permit | ||

44. (1) In the case of an application for a Contract for Services Employment Permit, the notice referred to in section 10A(3) of the Principal Act shall be placed— | ||

(a) with the Minister for Social Protection for publication on the EURES website for a minimum period of 14 days, | ||

(b) in at least one national newspaper for a minimum period of 3 days, and | ||

(c) either— | ||

(i) in a newspaper referred to in section 10A(4)(a)(iii)(I), or | ||

(ii) on a website referred to in section 10A(4)(a)(iii)(II), | ||

for a minimum period, in either case, of 3 days. | ||

(2) In the case of an application for a Contract for Services Employment Permit, the notice referred to in section 10A(3) of the Principal Act shall contain— | ||

(a) a description of the employment, | ||

(b) the name of the contractor, | ||

(c) the minimum annual remuneration of the employment, | ||

(d) the location(s) at which the employment is to be carried out, and | ||

(e) the hours of work of the employment. | ||

(3) In the case of an application for a Contract for Services Employment Permit, the employments referred to in section 10A(7)(a) of the Principal Act, to which the requirement to publish a notice under section 10A(2) of the Principal Act shall not apply, are— | ||

(a) the employments listed in Schedule 3, and | ||

(b) all other employments, other than the employments referred to in Regulation 43(2), for which the minimum annual remuneration is €60,000. | ||

Documentation and information required for grant of Contract for Services Employment Permit | ||

45. In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, for the purpose of section 6(g)(i) of the Act, the following information and documents shall be provided with an application for the grant of a Contract for Services Employment Permit: | ||

(a) information in relation to the contract service agreement under which it is proposed that the employee shall be providing services; and | ||

(b) other than in the case of an application for an employment permit in respect of an employment referred to in Regulation 44(3)— | ||

(i) the vacancy reference number of the notice referred to in Regulation 44(1)(a), and | ||

(ii) copies of the notices referred to in Regulation 44(1)(b) and (c), clearly showing the dates of publication of such notices. | ||

Minimum number of hours of work under Contract for Services Employment Permit | ||

46. The minimum number of hours of work required to be worked each week under a Contract for Services Employment Permit is 20. | ||

Minimum period of employment with contractor required for Contract for Services Employment Permit | ||

47. The minimum period of employment for which a foreign national referred to in section 3E(5) of the Principal Act shall be employed by the contractor before an application for a Contract for Services Employment Permit may be made in respect of him or her is 6 months. | ||

Remuneration documentation required for application for renewal of Contract for Services Employment Permit | ||

48. In addition to the information, documents and evidence prescribed under paragraphs (2) and (3) of Regulation 9, as applicable, the following shall be provided, and where necessary translated, with an application for the renewal of a Contract for Services Employment Permit: | ||

(a) documentation evidencing any payments made in respect of the board or accommodation of the holder of the employment permit; | ||

(b) documentation evidencing any payments made in respect of the health insurance of the holder of the employment permit, and | ||

(c) certified translations into English or Irish of any documentation referred to in paragraph (a) or (b), wherever such documentation is not in English or Irish. | ||

Form of Contract for Services Employment Permit | ||

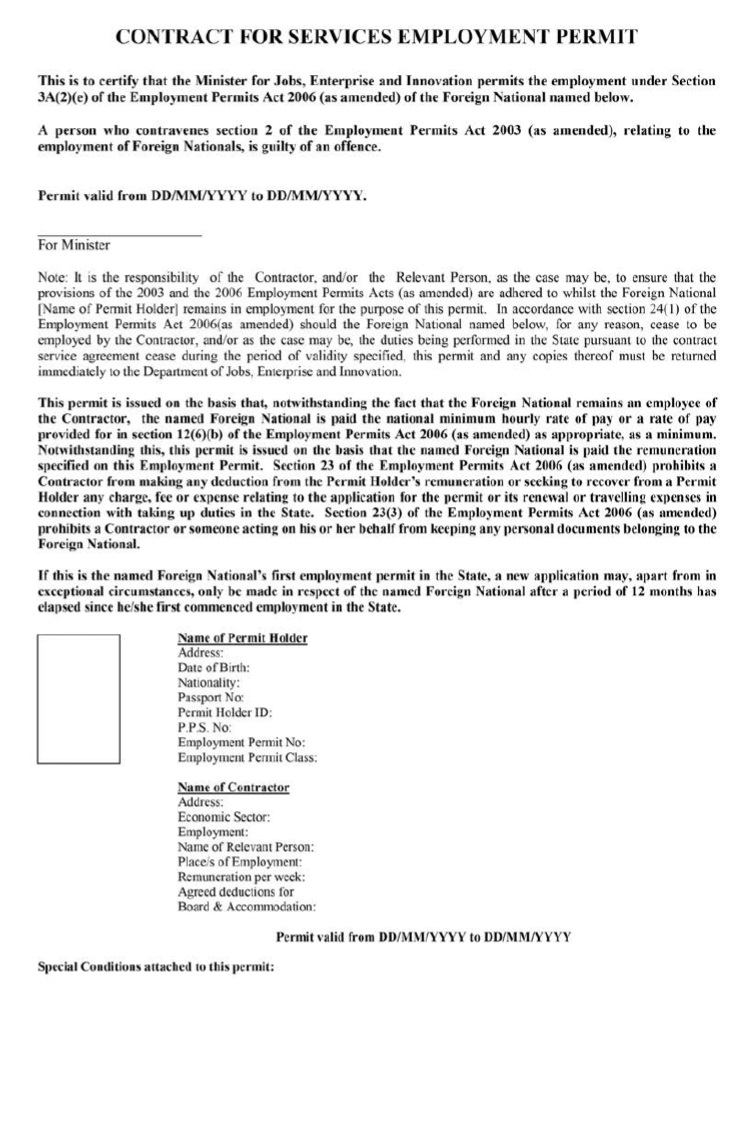

49. Form E in Schedule 6 is prescribed as the form of a Contract for Services Employment Permit. | ||

Part 9 | ||

Reactivation Employment Permit | ||

Name and purpose of Reactivation Employment Permit | ||

50. The name of the employment permit granted for the purpose referred to in section 3A(2)(f) of the Act shall be known as a ‘Reactivation Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Reactivation Employment Permit | ||

51. (1) Subject to paragraph (2), the employments for which a Reactivation Employment Permit may be granted are all employments the minimum annual remuneration for which is the minimum amount of remuneration to be paid for 39 hours of work in each week for 52 weeks and in respect of which the minimum remuneration hourly rate is— | ||

(a) declared by order under section 10D(1) (inserted by section 8 of the National Minimum Wage (Low Pay Commission) Act 2015 (No. 22 of 2015)) of the National Minimum Wage Act 2000 (No. 5 of 2000), or | ||

(b) where applicable, provided for in an employment regulation order made under section 42C(2) (inserted by section 12 of the Industrial Relations (Amendment) Act 2012 (No. 32 of 2012)) of the Industrial Relations Act 1946 (No. 26 of 1946), | ||

whichever is the higher. | ||

(2) A Reactivation Employment Permit shall not be granted for employment as a domestic operative. | ||

Minimum number of hours of work under Reactivation Employment Permit | ||

52. The minimum number of hours of work required to be worked each week under a Reactivation Employment Permit is 20. | ||

Documentation required for grant of Reactivation Employment Permit | ||

53. In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, an application for the grant of a Reactivation Employment Permit shall be accompanied by evidence of permission from the Minister for Justice and Equality to remain in the State for the purpose of making an application for an employment permit. | ||

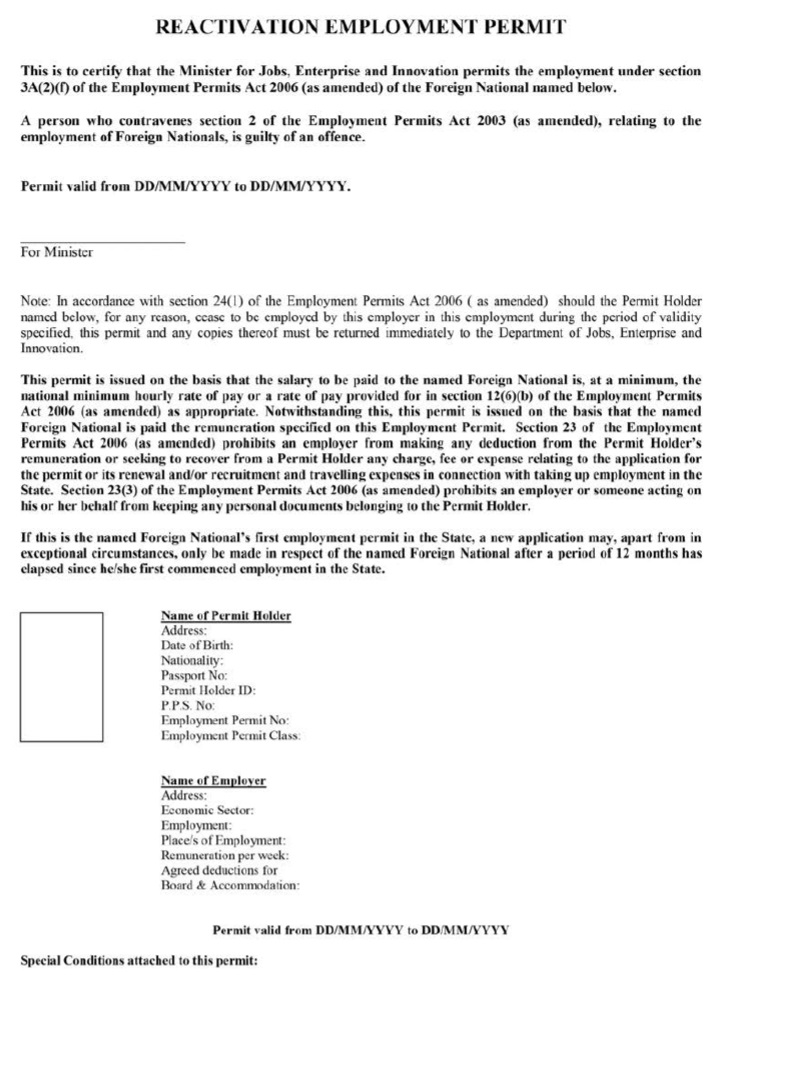

Form of Reactivation Employment Permit | ||

54. Form F in Schedule 6 is prescribed as the form of a Reactivation Employment Permit. | ||

Part 10 | ||

Exchange Agreement Employment Permit | ||

Name and purpose of Exchange Agreement Employment Permit | ||

55. The name of the employment permit granted for the purpose referred to in section 3A(2)(g) of the Act shall be known as an ‘Exchange Agreement Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Exchange Agreement Employment Permit | ||

56. The employments for which an Exchange Agreement Employment Permit may be granted are those that come within the scope of the exchange agreements listed in Schedule 5 and the minimum annual remuneration for which is the minimum amount of remuneration to be paid for 39 hours of work in each week for 52 weeks and in respect of which the minimum remuneration hourly rate is— | ||

(a) declared by order under section 10D(1) (inserted by section 8 of the National Minimum Wage (Low Pay Commission) Act 2015 (No. 22 of 2015)) of the National Minimum Wage Act 2000 (No. 5 of 2000), or | ||

(b) where applicable, provided for in an employment regulation order made under section 42C(2) (inserted by section 12 of the Industrial Relations (Amendment) Act 2012 (No. 32 of 2012)) of the Industrial Relations Act 1946 (No. 26 of 1946), | ||

whichever is the higher. | ||

Minimum number of hours of work under Exchange Agreement Employment Permit | ||

57. The minimum number of hours of work required to be worked each week under an Exchange Agreement Employment Permit is 20. | ||

Documentation required for grant of Exchange Agreement Employment Permit | ||

58. In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, an application for the grant of an Exchange Agreement Employment Permit shall be accompanied by a letter from the organisation operating the exchange agreement confirming that the exchange agreement applies to the foreign national in respect of whom the application for the grant of the Exchange Agreement Employment Permit is made. | ||

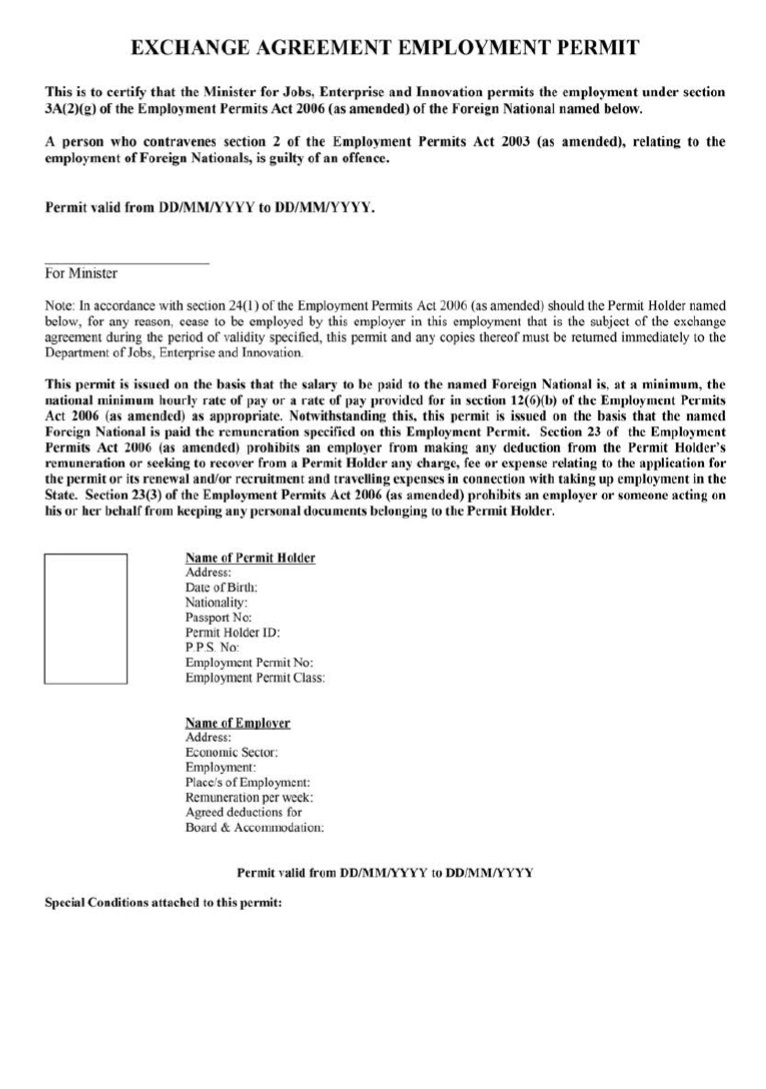

Form of Exchange Agreement Employment Permit | ||

59. Form G in Schedule 6 is prescribed as the form of an Exchange Agreement Employment Permit. | ||

Part 11 | ||

Sport and Cultural Employment Permit | ||

Name and purpose of Sport and Cultural Employment Permit | ||

60. The name of the employment permit granted for the purpose referred to in section 3A(2)(h) of the Act shall be known as a ‘Sport and Cultural Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Sport and Cultural Employment Permit | ||

61. (1) Subject to paragraph (2), the employments for which a Sport and Cultural Employment Permit may be granted are all employments required for the development and operation of sporting and cultural activities, and the minimum annual remuneration for which is the minimum amount of remuneration to be paid for 39 hours of work in each week for 52 weeks and in respect of which the minimum remuneration hourly rate is— | ||

(a) declared by order under section 10D(1) (inserted by section 8 of the National Minimum Wage (Low Pay Commission) Act 2015 (No. 22 of 2015)) of the National Minimum Wage Act 2000 (No. 5 of 2000), or | ||

(b) where applicable, provided for in an employment regulation order made under section 42C(2) (inserted by section 12 of the Industrial Relations (Amendment) Act 2012 (No. 32 of 2012)) of the Industrial Relations Act 1946 (No. 26 of 1946), | ||

whichever is the higher. | ||

(2) A Sport and Cultural Employment Permit shall not be granted in respect of an employment listed in Schedule 4. | ||

Minimum number of hours of work under Sport and Cultural Employment Permit | ||

62. The minimum number of hours of work required to be worked each week under a Sport and Cultural Employment Permit is 20. | ||

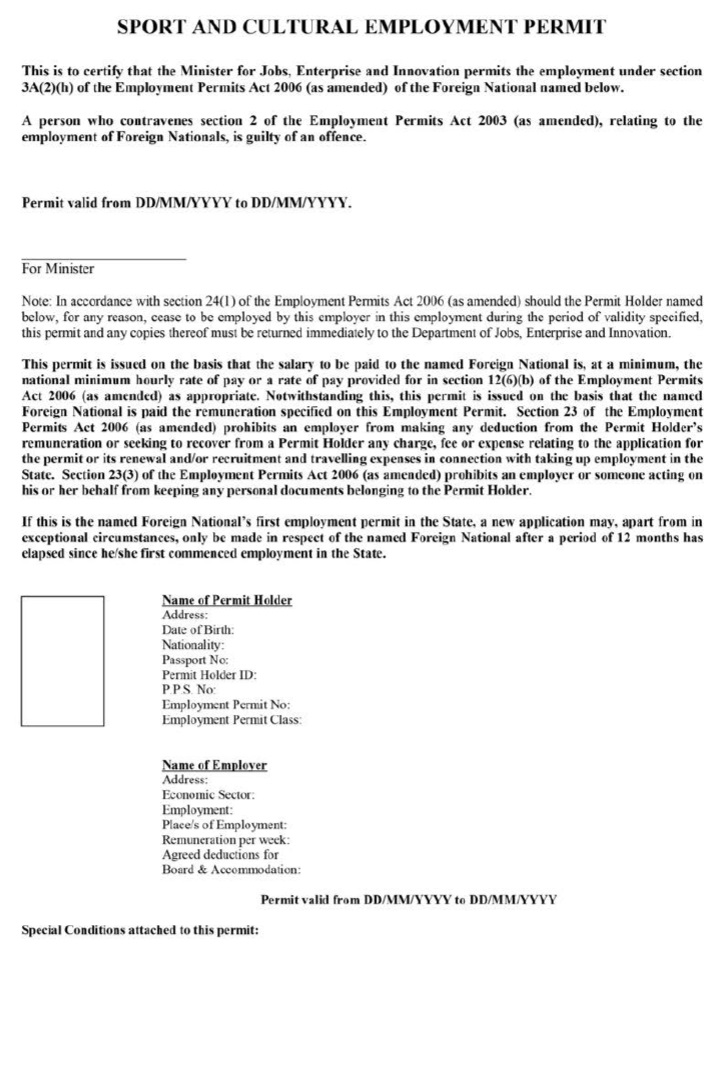

Form of Sport and Cultural Employment Permit | ||

63. Form H in Schedule 6 is prescribed as the form of a Sport and Cultural Employment Permit. | ||

Part 12 | ||

Internship Employment Permit | ||

Name and purpose of Internship Employment Permit | ||

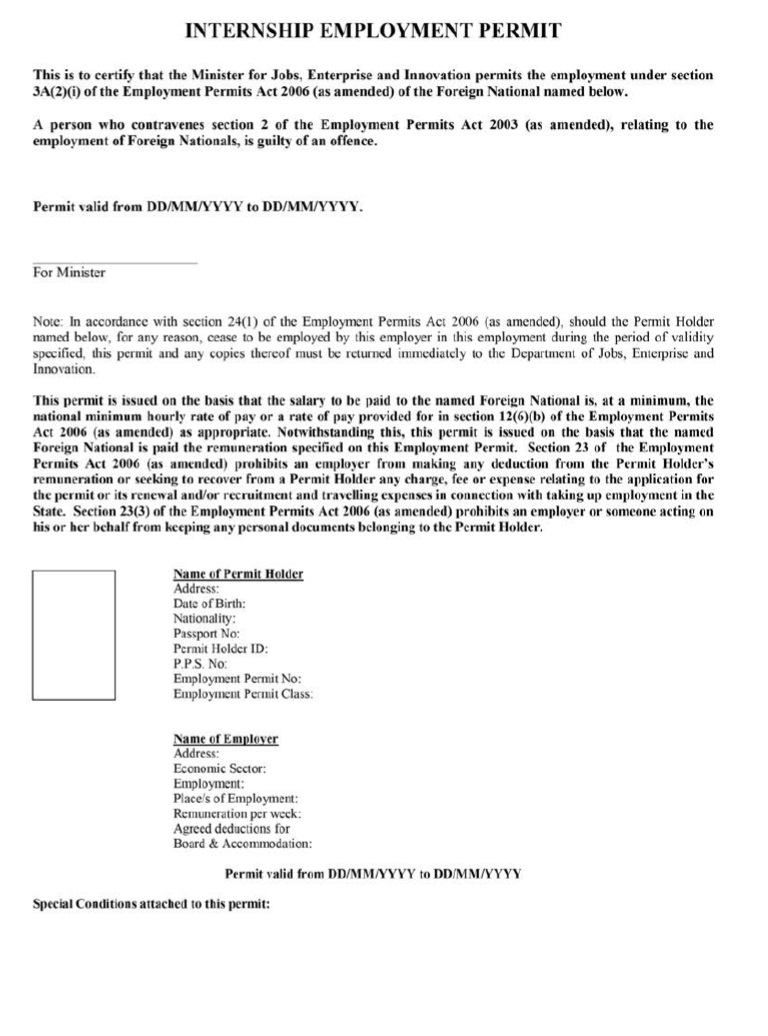

64. The name of the employment permit granted for the purpose referred to in section 3A(2)(i) of the Act shall be known as an ‘Internship Employment Permit’. | ||

Eligible employments and minimum annual remuneration for Internship Employment Permit | ||

65. The employments for which an Internship Employment Permit may be granted are the employments listed in Schedule 3, and the minimum annual remuneration for which is the minimum amount of remuneration to be paid for 39 hours of work in each week for 52 weeks and in respect of which the minimum remuneration hourly rate is— | ||

(a) declared by order under section 10D(1) (inserted by section 8 of the National Minimum Wage (Low Pay Commission) Act 2015 (No. 22 of 2015)) of the National Minimum Wage Act 2000 (No. 5 of 2000), or | ||

(b) where applicable, provided for in an employment regulation order made under section 42C(2) (inserted by section 12 of the Industrial Relations (Amendment) Act 2012 (No. 32 of 2012)) of the Industrial Relations Act 1946 (No. 26 of 1946), | ||

whichever is the higher. | ||

Documentation required for grant of Internship Employment Permit | ||

66. In addition to the information and documents prescribed under paragraphs (2) and (3) of Regulation 8, as applicable, an application for the grant of an Internship Employment Permit shall be accompanied by— | ||

(a) a letter from a third level institution outside the State— | ||

(i) confirming that the foreign national is enrolled as a full-time student at that institution, | ||

(ii) providing the name and description of the course of study in which the foreign national is enrolled, | ||

(iii) providing the qualifications or skills with which the course of study is wholly or substantially concerned, | ||

(iv) confirming that the employment in respect of which the application is made is wholly or substantially concerned with the course of study on which the foreign national is enrolled, | ||

(v) confirming that the foreign national is required, for the completion of the course of study, to obtain experience in the practice of the skills or qualifications with which the course of study is concerned for a period of not more than 12 months in an employment that requires the practice of those skills or qualifications, and | ||

(vi) confirming that the foreign national is required to return to the institution at the end of the 12 month period in order to complete the course of study, and | ||

(b) a letter from the person who has made the offer of employment— | ||

(i) confirming that the employment is for a period not exceeding 12 months, and | ||

(ii) stating the employment, as listed in Schedule 3, in which the foreign national is to be employed. | ||

Minimum number of hours of work under Internship Employment Permit | ||

67. The minimum number of hours of work required to be worked each week under an Internship Employment Permit is 20. | ||

Form of Internship Employment Permit | ||

68. Form I in Schedule 6 is prescribed as the form of an Internship Employment Permit. | ||

Part 13 | ||

Revocations and transitional arrangements | ||

Revocations | ||

69. Employment Permits Regulations 2014 ( S.I. No. 432 of 2014 ), the Employment Permits (Trusted Partner) Regulations 2015 ( S.I. No. 172 of 2015 ), the Employment Permits (Amendment) Regulations 2015 ( S.I. No. 349 of 2015 ), the Employment Permits (Amendment) (No. 2) Regulations 2015 ( S.I. No. 602 of 2015 ), the Employment Permits (Amendment) (No. 2) Regulations 2016 ( S.I. No. 363 of 2016 ) and the Employment Permits (Trusted Partner) (Amendment) Regulations 2016 ( S.I. No. 403 of 2016 ) are revoked. | ||

Transitional arrangements | ||

70. Where, immediately before the coming into operation of these Regulations, an application has been made under the Employment Permits Regulations 2014 or the Employment Permits (Trusted Partner) Regulations 2015, but no decision has been made in relation to it— | ||

(a) that application, and | ||

(b) any review of a decision made in relation to that application, | ||

shall be considered under these Regulations as if the application had been made after the coming into operation of these Regulations. | ||

Regulation 7 | ||

Schedule 1 | ||

Fees | ||

| ||

Regulations 8, 9 and 15 | ||

Schedule 2 | ||

Regulatory bodies or Government Minister from which or whom registration or recognition of qualifications required | ||

Part A | ||

Regulatory bodies from which a copy of the registration or licence, or alternatively a registration number, pin number or licence number, is required | ||

| ||

Part B | ||

Regulatory bodies or Government Minister from which or whom a copy of the registration or recognition of qualifications is required | ||

| ||

Part C | ||

Regulatory body or Government Minister that regulates the entry to or carrying on of the profession of the foreign national or of the employment concerned | ||

| ||

Regulations 18, 29, 31, 43, 44, 65 and 66 | ||

Schedule 3 | ||

Employments in respect of which there is a shortage in respect of qualifications, experience or skills which are required for the proper functioning of the economy | ||

| ||

Note: “SOC-3” and “SOC-4” refer to applicable levels in the Standard Occupational Classification system (SOC 2010). | ||

Regulations 18, 29, 31, 36, 43, 61 | ||

Schedule 4 | ||

Employments in respect of which an employment permit shall not be granted | ||

| ||

Note: “SOC-3” and “SOC-4” refer to applicable levels in the Standard Occupational Classification system (SOC 2010). | ||

Regulation 56 | ||

Schedule 5 | ||

Exchange agreements in respect of which Exchange Agreement Employment Permits may be granted | ||

1. Association Internationale des Étudiants en Sciences Économiques et Commerciales (“AIESEC”) | ||

2. The International Association for the Exchange of Students for Technical Experience (IAESTE) | ||

3. The Fulbright Programme | ||

4. Exchange between St. Joseph’s University, Philadelphia and University College Cork in conjunction with Bord Bia | ||

Regulations 21, 27, 34, 41, 49, 54, 59, 63, 68 | ||

Schedule 6 | ||

Forms — Employment Permits | ||

Form A | ||

| ||

Form B | ||

| ||

Form C | ||

| ||

Form D | ||

| ||

Form E | ||

| ||

Form F | ||

| ||

Form G | ||

| ||

Form H | ||

| ||

Form I | ||

| ||

| ||

GIVEN under my Official Seal, | ||

27 March 2017. | ||

MARY MITCHELL O’CONNOR, | ||

Minister for Jobs, Enterprise and Innovation. | ||

EXPLANATORY NOTE | ||

(This note is not part of the Instrument and does not purport to be a legal interpretation.) | ||

These Regulations consolidate and revoke the Employment Permits Regulations 2014 ( S.I. No. 432 of 2014 ), the Employment Permits (Trusted Partner) Regulations 2015 ( S.I. No. 172 of 2015 ), the Employment Permits (Amendment) Regulations 2015 ( S.I. No. 349 of 2015 ), the Employment Permits (Amendment) (No. 2) Regulations 2015 ( S.I. No. 602 of 2015 ), the Employment Permits (Amendment) (No. 2) Regulations 2016 ( S.I. No. 363 of 2016 ) and the Employment Permits (Trusted Partner) (Amendment) Regulations 2016 ( S.I. No. 403 of 2016 ). | ||

They set down the different classes of employment permit that may be granted by the Minister for Jobs, Enterprise and Innovation, for the purposes referred to in section 3A(2) of the Employment Permits Act 2006 , as inserted by the Employment Permits (Amendment) Act 2014 , and the qualifying criteria, application process, fees, review process with regard to decisions taken, and other matters in respect of such classes. They also set down the application process for a person who will make an offer of employment, an employer, a connected person or an EEA contractor to apply to the Minister for Trusted Partner Registration. | ||

These Regulations may be cited as the Employment Permits Regulations 2017. | ||